Understanding The Potential Tax Impacts from Burlington’s Upcoming Capital Projects

Learn how Burlington’s new school and police station projects may affect property taxes—and what relief options are available for residents.

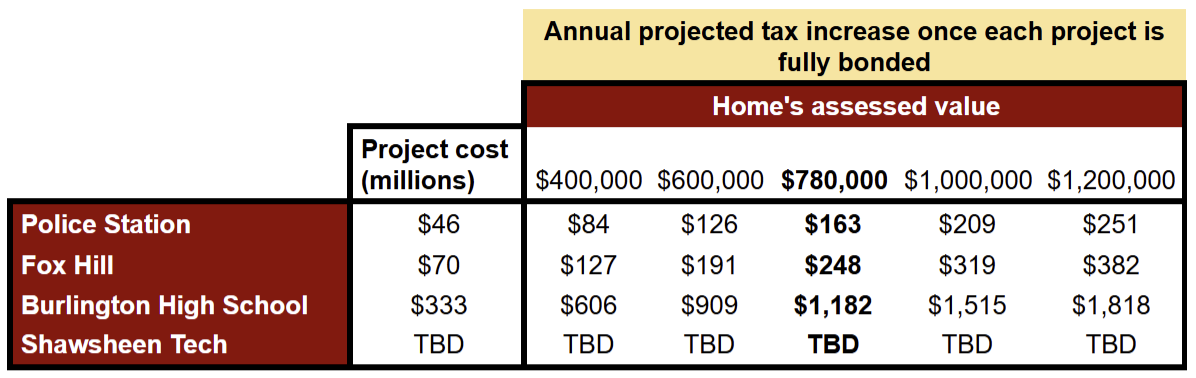

Burlington currently has two multi-million-dollar capital projects underway – a new Fox Hill Elementary School and a new police station – with more possible in the future, including a $333-million high school and the town's share of a new regional technical high school. Capital projects require tax dollars, and many residents are concerned the tax increases will be too much for them to afford.

Seniors, single-income households, individuals with disabilities, and those on fixed incomes are some groups that stand to be impacted by tax increases as a result of these projects. Here are some facts and resources to support community members now and in the future to understand what the tax increases might mean and how to get some relief.

The town has released projections for predicted increase in property taxes on the median home.

- These projections are based on the home's assessed value (set by the town), which is typically less than market value (set by the housing market and subject to fluctuate). The current median assessed home value is $780,000; the 50% of Burlington homes with an assessed value below that mark will see lower increases, and likewise homes assessed at more than $780,000 will have higher tax increases.

- The projections assume a 5% bond rate, which according to town administration is a higher interest rate than the town anticipates actually getting. Additionally, the projects work in a not-to-exceed budget number, meaning the actual project cost might be lower than currently estimated. In other words, actual increases might be lower than the projection.

- These increases would not hit all at once; rather they'd be incurred over time and be in full effect only after each project is fully bonded. The precise payment duration depends on many factors, but the town can expect to be paying for each project for about 25 years after it's bonded, all within the next 30 years.

The current estimates for annual tax increase on the median home value for each of the projects are as follows:

- Police Station: $163

- Fox Hill Elementary School: $248 after partial state reimbursement

- Burlington High School: $1182

- Shawsheen Valley Regional Technical High School: Too early to tell, but Burlington will have a share.

Use following chart for help estimating the tax impact for your specific situation:

Read the Daily Buzz and never miss a story from Burlington Buzz.

In Episode 2 of Burlington at Work, Town Administrator John Danizio shared several relief mechanisms offered by the state for individuals who meet certain qualifications and, though their qualifications are restrictive, these programs can offer some relief to taxpayers. Here are a few:

- Senior exemption for residents over the age of 65; must qualify for Circuit Breaker tax credit

- Tax deferral for seniors over 65 who earn less than $40,000 per year; defers all taxes in exchange for a lien on the home until sale of the home or death, then repayment of taxes + interest (currently at 4%) is required

- Senior work-off program: Volunteer to work in the town's municipal offices and have up to $2,000 of your annual property taxes forgiven

See the Tax Exemptions chart on the Town Assessor's website for more details. Danizio said the town's finance team will be collaborating with elected officials and the Ways and Means Committee to look into other possibilities that can support residents.

Other forms of assistance are available for those who need help with the cost of Medicare, food, and home energy.

Stay tuned to Burlington Buzz for more information about the upcoming capital projects, the November 15 special election, and more.